By Nicole Clark, Esq., Trellis Research

A Lawsuit Pandemic? The Oncoming Waves of Coronavirus Litigation

The past two decades have shown us that catastrophes and economic downturns can unleash tidal waves of lawsuits. After the attacks on September 11th, we witnessed a flood of filings that tested the limits of real estate insurance and health coverage policies for businesses and first responders at Ground Zero. Similarly, the Great Recession brought lawsuits against major financial institutions, claims alleging investors and regulators had intentionally been misled for years. What legal actions will the coronavirus pandemic bring?

Coronavirus Enters the Courts

As of May 19, 2020, 1,155 coronavirus-related complaints have been filed in federal and state courts across the United States. New York and California lead the nation with the most filings. However, unlike the Great Recession or the attacks on 9/11, the legal implications for the COVID-19 pandemic are different in their breadth and in their scale. These implications are raising new questions about the meanings of negligence, causation, and liability, terms that had previously been defined and adjudicated in contexts of normality. But what happens when a pandemic creates a new normal?

The types of lawsuits sparked by the coronavirus pandemic can be grouped into three broad categories:

- Labor and Employment Claims: Employees have started filing personal injury lawsuits and workers compensation claims against employers, alleging unsafe working conditions during the coronavirus outbreak. The plaintiffs range from nurses to retail workers. They claim that they contracted COVID-19 because their employers failed to fulfill their duty of care; they did not provide workers with protective gear, enforce social distancing measures, or adequately sanitize the workplace. Defendants have responded by deflecting legal liability, claiming that it is impossible to determine exactly how someone contracted the virus. (How can one show that the lack of personal protective equipment caused an employee to have contracted the virus? That the harm arose out of workplace activity?)

- Business to Consumer Claims: Consumers have demanded that companies ranging from airlines to gyms to ticket vendors issue refunds for coronavirus-related closures and cancellations. In a series of class action lawsuits, consumers have alleged that these businesses violated contractual agreements and consumer protections by continuing to charge membership fees for services that have been temporarily halted. As these cases move through the courts, plaintiffs will have to navigate the small print of those contracts, some of which include arbitration agreements or pandemic-related provisions.

- Business to Business Claims: A variety of businesses have filed lawsuits against insurance companies, claiming they have sidestepped their coverage obligations for business interruption policies. These lawsuits are testing the wording of these policies, which were written to cover direct physical loss or damage. According to the insurance companies, the policies were designed to address losses due to a fire or a burst water pipe—not a communicable disease. In fact, after the SARS outbreak, many insurance policies included provisions to exclude any fallout or losses from a virus.

But even this breakdown feels like a broad simplification. It overlooks all of the wrongful termination, employment discrimination, and federal WARN Act claims filed by laid off employees. It does not account for all of the prison confinement condition complaints or stay-at-home order challenges, by far the two largest types of claims filed thus far.

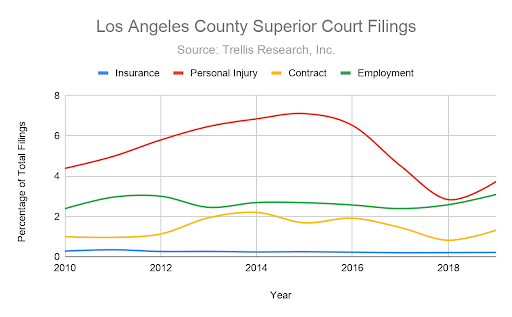

A Shifting Trend: The Effects of Coronavirus on Filings in Los Angeles County

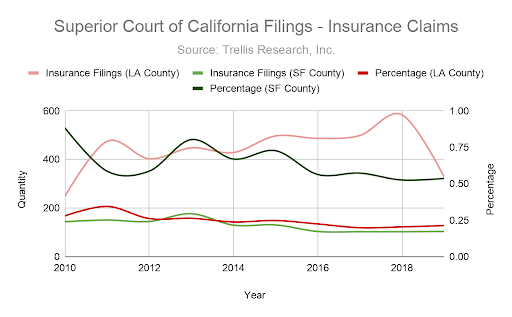

Still, we can take a closer look at these categories. The largest number of coronavirus-related insurance claims have been filed in California. In fact, insurance claims represent fourteen percent of all coronavirus-related filings across the state; one of the state’s largest categories of filings, just behind stay-at-home challenges. A majority of these claims are for declaratory judgment under the Civil Authority Coverage provision of their ‘all-risk’ insurance policies. A large number of these cases have been filed in the Superior Court of Los Angeles, a venue that has been historically dominated by personal injury and employment claims.

The percentage of insurance-related claims filed in the Superior Court of Los Angeles has experienced a downward trend since 2011. To give these figures some perspective, consider San Francisco County. Broadly speaking, the total quantity of insurance claims filed in the Superior Court of San Francisco is much lower than in Los Angeles. However, insurance claims have represented a larger percentage of the total number of the venue’s filings. Despite these differences, the Superior Court of San Francisco has also witnessed a steady decline in its percentage of insurance-related claims. As hotspots for recent coronavirus-related litigation, we can expect to see changes in the trends over the next year.

This Is Just the Beginning

The number of coronavirus-related filings will continue to rise for the next two to three years —perhaps the next decade. Uncertainty abounds in terms of how judges will handle these cases. This uncertainty is compounded by the decisions of public policymakers, who are working to reconfigure the legal landscape. California Governor Gavin Newsom, for example, issued Executive Order N-62-20, which mandates that “[a]ny COVID-19-related illness of an employee shall be presumed to arise out of … [their] employment for purposes of awarding workers’ compensation benefits.” Other states have already started imposing immunity measures for health-care institutions and nursing homes, measures designed to protect them from liability for coronavirus-related deaths. At the federal level, Congress is contemplating its own liability shields for businesses, with Senator Mitch McConnell advocating for broad liability protection as part of any future coronavirus legislation.

What is clear, however, is that the rulings from the first wave of coronavirus-related cases have the potential to break new legal ground. The lack of legal precedent for catastrophic events and the massive scale of the coronavirus pandemic will bring together case law and legal concepts (such as force majeure) that have not received widespread attention in decades.

The few rulings that have already trickled through the courts evidence narrow interpretations of legal matters. When asked, for example, whether or not COVID-19 particles can cause direct physical loss or damage to a property, one federal judge in New York ruled no, stating that the coronavirus “damages lungs. It does not damage printing presses.” So far, it looks like the potential for new legal ground remains just that—a potential.

Nicole Clark, Esq., is the CEO and co-founder of Trellis Research . She is a Business litigation and labor and employment attorney.

Trellis is an AI-powered legal research and analytics platform that makes trial court rulings searchable, and provides insights into the patterns and tendencies of opposing counsel, and state court judges.

Trellis is providing Century City Bar Association members with complimentary 14-day access to its platform. Click here to start your free trial today.